What does your retirement plan look like?

We can help fill the gaps of your questions without a sales pitch

Retirement income, tax-free strategies, Social Security, Medicare, wealth protection & growth

Overall Reviews

We all desire to have a lifetime flow of income to enjoy retirement. However, due to market ups and downs, taxes, inflation, and unforeseen medical expenses, we may be headed for disaster without even knowing it. How do we solve this issue? The answer is simple. Planning is key. We work with you to develop a plan that works today, then help you keep that plan updated. We use software that allows you to login anytime and make your own adjustments and see instant results for today and down the road…

Social Security and Pensions can seem complicated at first as there are many options. But we help you solve the problem by showing you how you can choose the right plan for yourself. Take the guessing out of it and use our software to compare the options. We have met so many who were on pace to choose the wrong direction. Once you choose, that is final. You cannot go back and fix it. So, we help you make the right decision the first time.

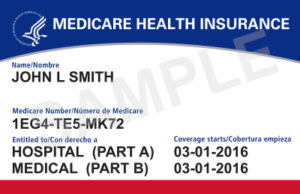

Medicare has many choices to choose from and we will help you simplify the process at NO COST…

We find many clients are not sure how much income they can live on in retirement. Som will live on too little and not really enjoy all their hard work of saving for retirement. We can show you how you can have confidence in what you spend. We have software that you will be able to see instant results with and know that your spending habits will not drive you into poverty or leave your estate with more than you plan..

Tax rates will change during your life. Likewise, inflation will change. We can help plan strategies to mitigate these risks.

70% of folks who turn 65 will need long-term care. A retirement plan should include the plan to pay or insure for it.

We can show you the best solutions for your circumstances which apply to different situations of assets, family, and business.

We find many clients tend to retire with money in a 401(k) or 403(b) retirement plan from work. In this scenario, they have most if not all their retirement savings at risk in the market. We believe in showing you how to partner RISK money with SAFE money. This gives you the ability to protect some of your assets while 100% of these funds are still based upon the market performance. Imagine, investing in the market with no risk and no fees on 25-50% of your total assets.

We all love a great market where we can earn a rate of return that is above our expectation. But what happens in retirement when we are taking money to live on and the market drops? This problem is called SEQUENCE OF RETURNS. In this situation, we teach you how to implement the strategy of using a VOLATILITY BUFFER.

Tax Strategies are important and should be reviewed on a regular basis. Most of us may have tax preparers but how many have an actual TAX ADVISOR? We take time to analyze and educate you on what potential savings are available to you. Then we suggest you review our plan with your local Tax Advisor.

Planning for Medical Bills can be complicated. Of course, there are your normal medical expenses paid for through the Medicare issues and then there is Long-Term Care. Many clients know this can be very expensive but are not aware of the many options one could use to asset protect a good portion of their funds. Let us show you how.

Passing wealth to our kids and grandkids can be rewarding. We love to show our clients how to leverage their wealth transfer options and possibly provide a lifetime tax free income for your family. If you like charities, we teach you how to be tax efficient in passing your money to those charities that really mean a lot to you. Contact us for more details.

The answer may not be long-term care insurance, but LTC insurance is a sound method. There are other solutions. The answer is unique to you and we can help you decide.

We can help fill the gaps of your questions without a sales pitch

We help you see where you're at and provide insights because that is our expertise—licensed, certified, BBB accredited,

Our purpose is to analyze your situation with you and create a quantified strategy.

Although with retirement in mind, your plan will likely address current financial tools and goals. We can limit the scope of planning to our services of long term care plans, social security timing, Medicare choices, tax mitigation & planning, income/pension designs, wealth transfer, life insurance, and any of our retirement analyzer solutions.

A correct claiming strategy can mean the difference of hundreds of thousands.

GET STARTED

Trusts, Life Insurance Trusts, Medical Directive, Power of Attory, Will, Wealth transfer strategies

GET STARTED

Planning is not necessarily through LTC insurance, but no plan could deplete all assets

GET STARTED

We look at “safe money”, tax implications, wealth transfer strategies, and creating an income stream.

GET STARTED

A program to dramatically improves returns for high net worth individuals

GET STARTEDService, not product